2015–16 Departmental Performance Report

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

(Click to read the Financial Statements, Supplementary Information Tables and Annex.)

ISSN 2368-4542

PDF Version: 2015-16 Departmental Performance Report

Table of Contents

Section I: Organizational Review

Section II: Expenditure Overview

- Actual Expenditures

- Budgetary Performance Summary

- Departmental Spending Trend

- Expenditures by Vote

- Alignment of Spending With the Whole of Government Framework

- Financial Statements and Financial Statements Highlights

Section III: Analysis of Program and Internal Services

Commissioner's Message

Commissioner

This report describes the performance and results achieved by the Office of the Public Sector Integrity Commissioner of Canada during Fiscal Year 2015-16. This was my first full year as Commissioner of Public Sector Integrity, a position I am proud and honoured to occupy.

Our priorities and the activities we undertake to achieve them are all focused on carrying out our core mandate: to provide a safe, confidential and trustworthy means of disclosing wrongdoing in the public sector and to provide recourse to public servants who have been victims of reprisal.

More specifically, we have focused our activities this past year on bringing increased efficiency and consistency to our operations, and on ensuring that potential whistleblowers and reprisal complainants have a clear and accurate understanding of what we do and how we can help them. Our goal is to strengthen the trust in our public institutions and in public servants, by building a robust, fair and independent whistleblowing regime. Our work to support this goal is carried out by dedicated professionals working together in an environment of continuous improvement.

Joe Friday

Public Sector Integrity Commissioner

Results Highlights

- Received, recorded and reviewed 86 new disclosures of wrongdoing and 30 new complaints of reprisal in compliance with the Public Servants Disclosure Protection Act.

- Developed and implemented new policy instruments that contributed to more consistent application of the Act and a more accessible and rigorous disclosure and reprisal management function.

- Carried out a review of intake and investigative processes using the "LEAN" methodology, which identified efficiencies and streamlined Office responsibilities and procedures.

- Conducted a focus group testing of public sector employees to better understand the perceptions and experiences of fear of reprisal.

- Staffed key positions to ensure efficient delivery of the Office mandate.

What funds were used?

$4,453,557

Actual Spending

Team members involved?

26

Actual FTEs

Section I: Organizational Overview

Organizational Profile

Appropriate Minister: The Honourable Scott Brison, President of the Treasury Board

Institutional Head: Joe Friday, Public Sector Integrity Commissioner

Ministerial Portfolio: Treasury Board Secretariat

Enabling Instrument(s): Public Servants Disclosure Protection Act, S.C. 2005, c. 46

Year of Incorporation / Commencement: 2007

Other: The Office of the Public Sector Integrity Commissioner of Canada supports the Public Sector Integrity Commissioner, who is an independent Agent of Parliament.

Organizational Context

Raison d’être

The Office of the Public Sector Integrity Commissioner of Canada (the Office) was set up to administer the Public Servants Disclosure Protection Act (the Act), which came into force in April 2007. The Office is mandated to establish a safe, independent, and confidential process for public servants and members of the public to disclose potential wrongdoing in the federal public sector. The Office also helps to protect public servants who have filed disclosures or participated in related investigations from reprisal.

The disclosure regime is an element of the framework which strengthens accountability and management oversight in government operations.

Responsibilities

The Office has jurisdiction over the entire federal public sector, including separate agencies and parent Crown corporations, which represents approximately 375,000 public servants. Under the Act, members of the general public can also come to the Office with information about a possible wrongdoing in the federal public sector. However, the Office does not have jurisdiction over the Canadian Forces, the Canadian Security Intelligence Service, and the Communications Security Establishment, each of which is required under the Act to establish internal procedures for disclosure of wrongdoing and protection against reprisal similar to those set out in the Act.

The Office conducts independent reviews and investigations of disclosures of wrongdoing and complaints of reprisal in a fair and timely manner. In cases of founded wrongdoing, the Commissioner issues findings, through the tabling of a case report to Parliament, and makes recommendations to chief executives for corrective action. The Commissioner exercises exclusive jurisdiction over the review, investigation and conciliation of reprisal complaints. This includes making applications to the Public Servants Disclosure Protection Tribunal, which has the power to determine if reprisals have taken place and to order appropriate remedial and disciplinary action.

The Office is guided at all times by the public interest and the principles of natural justice and procedural fairness. The Commissioner submits an annual report to Parliament and special reports may also be submitted to Parliament at any time.

More information about the Office’s mandate, roles, responsibilities, activities, statutory reports and the Act can be found on the Office’s website.

Strategic Outcome(s) and Program Alignment Architecture

1. Strategic Outcome: Wrongdoing in the federal public sector is addressed and public servants are protected in case of reprisal

1.1 Program: Disclosure and Reprisal Management Program

Internal Services

Operating Environment and Risk Analysis

The Office’s environment is a complex one that reflects its sensitive mandate. The work requires a high degree of care as each case we handle directly impacts the lives and reputations of individuals and organizations.

Despite the existence of formal mechanisms to facilitate the disclosure of wrongdoing and to protect against and prevent reprisals, there still exists a culture of resistance to whistleblowing within the federal public service due to various factors, including fear of reprisal. This plays a fundamental role in an individual’s decision to disclose wrongdoing. This informs outreach and engagement strategies to increase awareness of the whistleblowing regime, to clarify the role of the Office, and to build trust in the Office.

Media and public interest have demonstrated the need and growing demand to respond to concerns about integrity in both the private and public sectors. Integrity regimes at provincial and municipal levels, as well as in other countries, vary in terms of legislation, mandate, powers, jurisdiction and organizational structures. However, they provide opportunities for benchmarking and sharing best practices and research.

The use of social media (such as blogs, Facebook and Twitter) by Canadians, public servants and the government itself is becoming a prevalent means of communicating and interacting. The Office is faced with the challenge of determining the most appropriate way to leverage these technologies to communicate and interact with Canadians and public servants.

The Office is working with a multi-stakeholder Advisory Committee to communicate and engage with external stakeholders on an ongoing and proactive basis and to respond to emerging issues clearly and in a respectful and timely manner.

Within the Office itself, there are challenges sourcing and retaining individuals with the right mix of skills. The labour market for key skilled positions, such as investigators, is and will likely become even more competitive.

New technologies are emerging that could better help the Office manage its corporate knowledge (i.e., information management) as well as its administration, accessibility, case management and performance statistics.

As much of the Office’s work is case driven, it can be difficult to predict the timing and volume of workloads. Risks can arise from events that the Office cannot influence or by factors outside our control, but the Office must be able to monitor, respond and mitigate the impact accordingly, in order to fully and efficiently address disclosures of wrongdoing and complaints of reprisal. In 2015-16, the Office experienced a backlog in disclosure cases received created in most part by a reduced human resources capacity. The Office carried out a “LEAN” review of its processes, increased its capacity and produced monthly service standard reports. This ensured the disclosure and reprisal management function continues to be timely, rigorous, independent and accessible to support effective and efficient use of resources and clear evidence-based case file decisions, minimizing the need for further allocations of resources. The Audit and Evaluation Committee provides advice to the Commissioner on risk and annually reviews the Office’s risk profile.

Key Risks

| Risk | Risk Response Strategy | Link to the Organization's Profile |

|---|---|---|

| Case Volumes: The Office’s ability to respond in a timely manner can be impacted by increasing case volumes or if the mix of complexity in the case workload increases. | This risk was identified in the 2015-16 RPP. Carried out a “LEAN” review of processes and monthly reporting on compliance with service standards and trends that ensured management was informed and that actions were taken as appropriate. | Disclosure and Reprisal Management Program |

| Information Security: This is critical in the context of disclosures, investigations and the need for preserving confidentiality and trust in the Office. Sensitive or private information must be protected from potential loss or inappropriate access in order to avoid potential litigation, damaged reputation and further reluctance in coming forward. | This risk was identified in the 2015-16 RPP. The Office has ongoing practices aimed at ensuring the security of information, which include security briefings and confidentiality agreements, random information security checks within premises, and controlled access for the storage of sensitive information. | Disclosure and Reprisal Management Program |

Organizational Priorities

Name of Priority

Disclosure and reprisal management function that is timely, rigorous, independent and accessible.

Description

An effective and appropriate response to those individuals who approach or interact with the Office is the cornerstone of creating trust in the organization and assuring Canadians that this important mechanism is supporting an environment of accountability.

Priority Type

Ongoing

Key Supporting Initiatives

| Planned Initiatives | Start Date | End Date | Status | Link to the Organization’s Program |

|---|---|---|---|---|

| Maintain evergreen policies and processes of disclosures and reprisal complaints. | October 2013 | To be determined | On track | Disclosure and Reprisal Management Program |

| Enhance technological capacity and information management systems of disclosure and reprisal cases. | April 2015 | To be determined | On track | |

| Maintain program reporting and monitoring, including performance against service standards and quality assessments. | April 2013 | To be determined | On track | |

| Continue to evaluate, document, and prioritize proposed amendments to the Act. | April 2015 | To be determined | On track | |

| Progress Toward the Priority | ||||

| ||||

Name of Priority

Awareness and understanding of the whistleblowing regime

Description

Outreach across the public sector is fundamental in creating awareness and clarity about the Act and the role of the Office. It is not uncommon that public servants fear reprisal which may impede their willingness and level of comfort in making a disclosure of wrongdoing.

Priority Type

Ongoing

Key Supporting Initiatives

| Planned Initiatives | Start Date | End Date | Status | Link to the Organization’s Program(s) |

|---|---|---|---|---|

| Implement the Office’s Outreach and Engagement Strategy | June 2012 | To be determined | On track | Disclosure and Reprisal Management Program |

| Implement new and enhanced communications approaches with the public and public servants | January 2014 | To be determined | On track | |

| Progress Toward the Priority | ||||

| ||||

Name of Priority

Human resource capacity that meets organizational needs

Description

The success of the Office is dependent on hiring, retaining and engaging employees with the knowledge, skills, and experience that work as team and independently. It is recognized that the impact of turnover in a small organization can create challenges for knowledge transfer, succession planning and corporate memory.

Priority Type

Ongoing

Key Supporting Initiatives

| Planned Initiatives | Start Date | End Date | Status | Link to the Organization’s Program(s) |

|---|---|---|---|---|

| Staff key positions | April 2015 | To be determined | On track | Disclosure and Reprisal Management Program |

| Maximize staff engagement and retention and implement strategic learning and development plans. | April 2015 | To be determined | On track | |

| Ensure timely availability of qualified staff, applying effective tools and processes in place to facilitate and expedite recruitment and resourcing needs. | May 2013 | To be determined | On track | |

| Progress Toward the Priority | ||||

| ||||

For more information on organizational priorities, see the Minister's mandate letter.

Section II: Expenditure Overview

Actual Expenditures

Budgetary Financial Resources (dollars)

| 2015–16 Main Estimates | 2015–16 Planned Spending | 2015–16 Total Authorities Available for Use | 2015–16 Actual Spending (authorities used) | Difference (actual minus planned) |

|---|---|---|---|---|

| 5,448,442 | 5,448,442 | 5,448,442 | 4,453,560 | (994,882) |

Human Resources (Full-Time Equivalents [FTEs])

| 2015–16 Planned | 2015-16 Actual | 2015-16 Difference (actual minus planned) |

|---|---|---|

| 28 | 26 | (2) |

Budgetary Performance Summary

| Program(s) and Internal Services | 2015–16 Main Estimates | 2015–16 Planned Spending | 2016–17 Planned Spending | 2017–18 Planned Spending | 2015–16 Total Authorities Available for Use | 2015–16 Actual Spending (authorities used) | 2014–15 Actual Spending (authorities used) | 2013–14 Actual Spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Disclosure and Reprisal Management | 3,418,985 | 3,418,985 | 3,564,227 | 3,564,227 | 3,418,985 | 2,644,499 | 2,692,847 | 3,608,322 |

| Internal Services | 2,029,457 | 2,029,457 | 1,898,247 | 1,898,247 | 2,029,457 | 1,809,061 | 2,148,180 | 1,934,719 |

| Total | 5,448,442 | 5,448,442 | 5,462,474 | 5,462,474 | 5,448,442 | 4,453,560 | 4,841,027 | 5,543,041 |

The Office's total 2015-16 spending of $4.5 million is $1.0 million (18%) lower than its planned spending of $5.5 million. The overall lower level of authorities used in comparison to the planned spending was a result of unplanned vacancies, delayed staffing and a reduced use of external resources. Personnel costs of the Office in 2015-16 accounted for 65% of spending and professional fees accounted for 21% of spending.

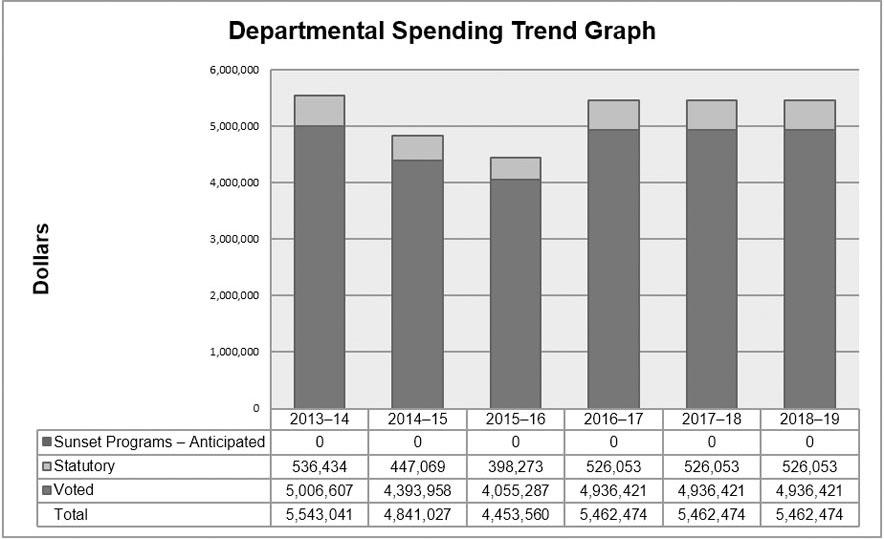

Departmental Spending Trend

Text Version

This bar graph illustrates the spending trend for the Office’s program expenditures (Vote 1) related to actual spending for fiscal years 2013–14, 2014-15 and 2015–16, and planned spending for fiscal years 2016–17, 2017–18 and 2018–19. Financial figures are presented in dollars along the y axis, increasing by $1 million increments to $6 million. These are graphed against fiscal years 2013–14 to 2018–19 on the x axis.

There are three items identified for each fiscal year, the first one being sun-setting programs, the second relates to statutory items, comprised of contributions to employee benefit plans, and the third, the Office's program expenditures (Vote 1).

The Office has only one program, hence no sunset program was recorded or is anticipated.

In 2013–14, actual spending was $536,434 for statutory items and $5,006,607 for program expenditures.

In 2014–15, actual spending was $447,069 for statutory items and $4,393,958 for program expenditures.

In 2015–16, actual spending was $398,273 for statutory items and $4,055,287 for program expenditures.

Planned spending for statutory items will remain the same for fiscal years 2016–17 to 2018–19 in the amount of $526,053.

Planned spending for program expenditures will remain the same for fiscal years 2016–17 to 2018–19 in the amount of $4,936,421.

The decrease in total spending in the last three years reflects the lower level of staffed positions and reduced project spending. The Office is planning a return to the 2013-14 level of spending, starting in 2016-17, as vacant positions are staffed and office projects are implemented to continue working efficiently towards our priorities.

Expenditures by Vote

For information on the Office of the Public Sector Integrity Commissioner of Canada’s organizational voted and statutory expenditures, consult the Public Accounts of Canada 2016.

Alignment of Spending With the Whole-of-Government Framework

Alignment of 2015-16 Actual Spending With the Whole-of-Government Framework (dollars)

| Program | Spending Area | Government of Canada Outcome | 2015–16 Actual Spending |

|---|---|---|---|

| Disclosure and Reprisal Management | Government Affairs | A transparent, accountable and responsive federal government | 2,644,499 |

Total Spending by Spending Area (dollars)

| Spending Area | Total Planned Spending | Total Actual Spending |

|---|---|---|

| Economic affairs | 0 | 0 |

| Social affairs | 0 | 0 |

| International affairs | 0 | 0 |

| Government affairs | 3,418,985 | 2,644,499 |

Financial Statements and Financial Statements Highlights

Financial Statements

The Office of the Public Sector Integrity Commissioner Audited Financial Statements for the Year Ended March 31, 2016, which include the Statement of Management Responsibility Including Internal Control over Financial Reporting and its Annex for fiscal year 2015–16, can be found on the Office's website.

Financial Statements Highlights

| Financial Information | 2015–16 Planned Results | 2015–16 Actual | 2014–15 Actual | Difference (2015–16 actual minus 2015–16 planned) | Difference (2015–16 actual minus 2014–15 actual) |

|---|---|---|---|---|---|

| Total expenses | 6,189,365 | 5,098,876 | 5,398,175 | (1,090,489) | (299,299) |

| Total revenues | 0 | 0 | 0 | 0 | 0 |

| Net cost of operations before government funding and transfers | 6,189,365 | 5,098,876 | 5,398,175 | (1,090,489) | (299,299) |

The actual total expenses of $5.1 million reflect a decrease of $0.3 million as compared with 2014-15 and, is primarily due to a reduction in personnel costs of $0.26 million as a result of the vacant positions and a reduced requirement for external operational resources.

| Financial Information | 2015–16 | 2014–15 | Difference (2015–16 minus 2014–15) |

|---|---|---|---|

| Total net liabilities | 828,904 | 840,147 | (11,243) |

| Total net financial assets | 494,430 | 466,014 | 28,416 |

| Departmental net debt | 334,474 | 374,133 | (39,659) |

| Total non-financial assets | 149,958 | 171,658 | (21,700) |

| Departmental net financial position | (184,516) | (202,475) | 17,959 |

The total liabilities, as at the end of the year, were $0.8 million, composed of accounts payable, accrued salaries, employee future severance benefits and vacation pay liabilities. The total financial assets as at the end of the year were $0.5 million and reflect amounts due from the Consolidated Revenue Fund and amounts in accounts receivable (primarily from other government departments). Departmental net debt of $0.3 million, calculated as the difference between total net liabilities less net financial assets, has decreased slightly compared to the previous year, which is mainly explained by an increase in accounts receivable from other government departments. The net debt indicator represents future funding requirements to pay for past transactions and events, and is one indicator of a department's financial position. The total non-financial assets reflect the net book value of capital assets as at March 31 and have decreased as the assets are being amortized over their expected useful life and minimal new investments in capital were made in 2015-16.

Section III: Analysis of Program and Internal Services

Program

Disclosure and Reprisal Management Program

Description

The objective of the program is to address disclosures of wrongdoing and complaints of reprisal and contribute to increasing confidence in federal public institutions. It aims to provide advice to federal public sector employees and members of the public who are considering making a disclosure and to accept, investigate and report on disclosures of information concerning possible wrongdoing. Based on this activity, the Public Sector Integrity Commissioner will exercise exclusive jurisdiction over the review, conciliation and settlement of complaints of reprisal, including making applications to the Public Servants Disclosure Protection Tribunal to determine if reprisals have taken place and to order appropriate remedial and disciplinary action.

Program Performance Analysis and Lessons Learned

The Office tabled one case report of wrongdoing in Parliament and made one application regarding a complaint of reprisal to the Tribunal. The case report, along with other operational achievements are summarized in the Annual Report on the Office’s website. The Office received 165 general inquiries, 86 new disclosures of wrongdoing and 30 new complaints of reprisal. The progress on action plans was highlighted in Section I under Organizational Priorities.

The legislation requires a case analysis of complaints of reprisal be completed in 15 days and, against this standard, the Office achieved a 100% level of compliance. In 2015, the Office published and reported on its self-determined service standards, which include:

- General inquiries will be responded to within 1 working day, which was achieved for 90% of the enquiries.

- Conducting case analysis for disclosures of wrongdoing within 90 days of opening a file which determines if an investigation will be launched. This service standard was achieved on 33% of the files.

- Investigations will be completed within one year of being launched. This service standard was achieved on 50% of the files.

As identified in the Operating Environment and Risk Analysis section, over the course of this reporting period, the Office experienced a backlog in disclosure cases received created in most part by a reduced human resources capacity. This situation also impacted the financial performance as operating projects and related spending were delayed. To address these issues, the Office completed the “LEAN” review of its processes and was successful at increasing its capacity. These actions resulted in the backlog being addressed, and they prepared the Office to plan for and manage similar challenges in the future.

Budgetary Financial Resources (dollars)

| 2015–16 Main Estimates | 2015–16 Planned Spending | 2015–16 Total Authorities Available for Use | 2015–16 Actual Spending (authorities used) | 2015–16 Difference (actual minus planned) |

|---|---|---|---|---|

| 3,418,985 | 3,418,985 | 3,418,985 | 2,644,499 | (774,486) |

Human Resources (Full-Time Equivalents [FTEs])

| 2015–16 Planned | 2015–16 Actual | 2015–16 Difference (actual minus planned) |

|---|---|---|

| 20 | 19 | (1) |

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| The disclosure and reprisal management function is efficient | Compliance with service standard - Decision whether to investigate a complaint of reprisal is made within 15 days | 100% | 100% |

| The disclosure and reprisal management function is efficient | Compliance with service standard - General inquiries are responded to within one working day | 80% | 90% |

| The disclosure and reprisal management function is efficient | Compliance with service standard - Decision whether to investigate a disclosure of wrongdoing is made within 90 days | 80% | 33% |

| The disclosure and reprisal management function is efficient | Compliance with service standard - Investigations are completed within 1 year | 80% | 50% |

| The disclosure and reprisal cases are addressed with decisions that are clear and complete. | Successful applications for judicial review in comparison to the total number of cases received over three years | No more than 2% | 0.3% |

Internal Services

Description

Internal services are groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of an organization. Internal services include only those activities and resources that apply across an organization, and not those provided to a specific program. The groups of activities are Management and Oversight Services; Communications Services; Legal Services; Human Resources Management Services; Financial Management Services; Information Management Services; Information Technology Services; Real Property Services; Materiel Services; and Acquisition Services.

Program Performance Analysis and Lessons Learned

The Office continued to access shared services from other government departments for the cost-effective delivery of human resources, finance, security, and information technology services.

During the year, the Office developed control lists, specifically for small government organizations, per the Treasury Board Policy on Internal Control. These key controls will help maintain and monitor the Office’s system of internal controls to mitigate risks in financial and information technology related processes.

The planned internal audit of Disclosures of Wrongdoing and Complaints of Reprisal by March 2016 was delayed to 2017-18 as it was determined prudent to await the “LEAN” review of the operational processes.

Budgetary Financial Resources (dollars)

| 2015–16 Main Estimates | 2015–16 Planned Spending | 2015–16 Total Authorities Available for Use | 2015–16 Actual Spending (authorities used) | 2015–16 Difference (actual minus planned) |

|---|---|---|---|---|

| 2,029,457 | 2,029,457 | 2,029,457 | 1,809,061 | (220,396) |

Human Resources (FTEs)

| 2015–16 Planned | 2015–16 Actual | 2015–16 Difference (actual minus planned) |

|---|---|---|

| 8 | 7 | (1) |

Section IV: Supplementary Information

Supplementary Information Tables

The following supplementary information tables are available on the Office of the Public Sector Commissioner’s website.

- Departmental Sustainable Development Strategy

- User Fees, Regulatory Charges and External Fees

Federal Tax Expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures annually in the Report of Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs. The tax measures presented in this report are the responsibility of the Minister of Finance.

Organizational Contact Information

60 Queen Street, 7th Floor

Ottawa, Ontario K1P 5Y7

Canada

Telephone: 613-941-6400

Toll Free: 1-866-941-6400

Appendix: Definitions

appropriation (crédit): Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires): Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

Departmental Performance Report (rapport ministériel sur le rendement): Reports on an appropriated organization’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Reports on Plans and Priorities. These reports are tabled in Parliament in the fall.

full time equivalent (équivalent temps plein): A measure of the extent to which an employee represents a full person year charge against a departmental budget. Full time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

Government of Canada outcomes (résultats du gouvernement du Canada): A set of 16 high level objectives defined for the government as a whole, grouped in four spending areas: economic affairs, social affairs, international affairs and government affairs.

Management, Resources and Results Structure (Structure de la gestion, des ressources et des résultats): A comprehensive framework that consists of an organization’s inventory of programs, resources, results, performance indicators and governance information. Programs and results are depicted in their hierarchical relationship to each other and to the Strategic Outcome(s) to which they contribute. The Management, Resources and Results Structure is developed from the Program Alignment Architecture.

non budgetary expenditures (dépenses non budgétaires): Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

performance (rendement): What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

performance indicator (indicateur de rendement): A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

performance reporting (production de rapports sur le rendement): The process of communicating evidence based performance information. Performance reporting supports decision making, accountability and transparency.

planned spending (dépenses prévues): For Reports on Plans and Priorities (RPPs) and Departmental Performance Reports (DPRs), planned spending refers to those amounts that receive Treasury Board approval by February 1. Therefore, planned spending may include amounts incremental to planned expenditures presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their RPPs and DPRs.

plans (plan): The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result. priorities (priorité): Plans or projects that an organization has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired Strategic Outcome(s).

program (programme): A group of related resource inputs and activities that are managed to meet specific needs and to achieve intended results and that are treated as a budgetary unit.

Program Alignment Architecture (architecture d’alignement des programmes): A structured inventory of an organization’s programs depicting the hierarchical relationship between programs and the Strategic Outcome(s) to which they contribute.

Report on Plans and Priorities (rapport sur les plans et les priorités): Provides information on the plans and expected performance of appropriated organizations over a three year period. These reports are tabled in Parliament each spring.

results (résultat): An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

statutory expenditures (dépenses législatives): Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

Strategic Outcome (résultat stratégique): A long term and enduring benefit to Canadians that is linked to the organization’s mandate, vision and core functions.

sunset program (programme temporisé): A time limited program that does not have an ongoing funding and policy authority. When the program is set to expire, a decision must be made whether to continue the program. In the case of a renewal, the decision specifies the scope, funding level and duration. target (cible): A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées): Expenditures that Parliament approves annually through an Appropriation Act. The Vote wording becomes the governing conditions under which these expenditures may be made.

Whole of government framework (cadre pangouvernemental): Maps the financial contributions of federal organizations receiving appropriations by aligning their Programs to a set of 16 government wide, high level outcome areas, grouped under four spending areas.